Filing an Income Tax Return (ITR) is a legal responsibility for individuals, professionals, and businesses in India. Whether you are a salaried employee, freelancer, or business owner, having the right documents ready makes the ITR filing process smooth, accurate, and hassle-free.

In this blog, we explain all the essential documents required for filing Income Tax Return in India, category-wise, so you don’t miss anything important.

Why Are Documents Important for ITR Filing?

Documents help:

- Calculate correct taxable income

- Claim deductions and exemptions legally

- Avoid errors, penalties, or income tax notices

- Ensure faster processing of refunds

Incomplete or incorrect documents can lead to wrong filing or delayed refunds.

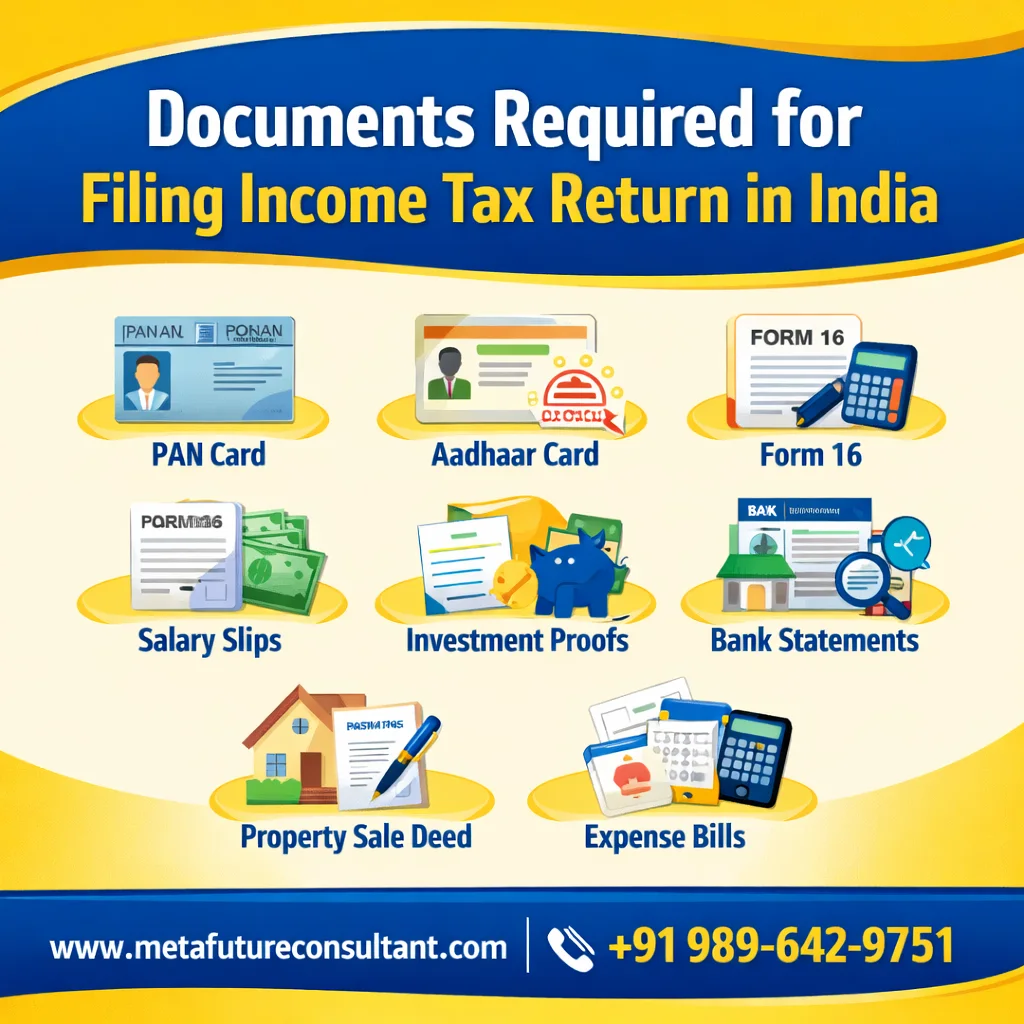

Basic Documents Required for All Taxpayers

These documents are mandatory for almost everyone filing ITR:

- PAN Card

- Aadhaar Card

- Bank Account Details

✔ Bank name

✔Account number

✔ IFSC coad

- Mobile number linked with Aadhaar

- Previous year ITR (if filed earlier)

Documents Required for Salaried Employees

If you are a salaried individual, keep the following documents ready:

1. Form 16

- Issued by your employer

- Contains salary details and TDS information

2. Salary Slips

- Monthly or annual salary slips for cross-verification

3. Investment Proofs (for deductions)

- Life Insurance (LIC) receipts

- ELSS mutual fund statements

- PPF / EPF contribution proof

- Tuition fee receipts (Section 80C)

4. Rent Receipts (If claiming HRA)

- Rent agreement (if applicable)

- Landlord’s PAN (if rent exceeds ₹1 lakh annually)

Additionally, deductions under Section 80C, 80D, and other sections can also be claimed.

Documents Required for Self-Employed & Freelancers

For freelancers, consultants, and professionals:

- PAN & Aadhaar

- Bank Statements

- Income details / invoices

- Profit & Loss Statement

- Expense proofs (internet bills, rent, travel, software tools, etc.)

- Presumptive income details (if filing under Sections 44AD / 44ADA)

- Electricity bills (work portion)

Documents Required for Business Owners

Business owners need additional records:

- Books of accounts

- Balance Sheet

- Profit & Loss Account

- GST Returns (if applicable)

- Audit report (if required)

- Business bank statements

Documents Required for Capital Gains Income

If you have sold property, shares, or mutual funds:

- Sale deed / purchase deed

- Capital gain statements

- Broker statements

- Investment proof for exemptions (Section 54, 54F, etc.)

Documents Required for Other Income Sources

Interest Income

- Bank interest certificates

- Fixed deposit interest statements

- Savings account interest details

Rental Income

- Rent receipts

- Municipal tax receipts

- Home loan interest certificate (if applicable)

Documents Required to Claim Deductions

To claim tax-saving deductions, keep these documents:

- Health insurance premium receipts (Section 80D)

- Education loan interest certificate (Section 80E)

- Donation receipts (Section 80G)

- Disability certificate (if applicable)

- Pension contribution receipts (NPS – Section 80CCD)

Conclusion

Having the correct documents ready is the first and most important step in filing your Income Tax Return in India. Whether you are a salaried employee, freelancer, or business owner, organized documentation ensures accurate filing, maximum deductions, and faster refunds.

If you’re unsure about documentation or filing, consulting a tax expert can save you time and prevent costly mistakes.