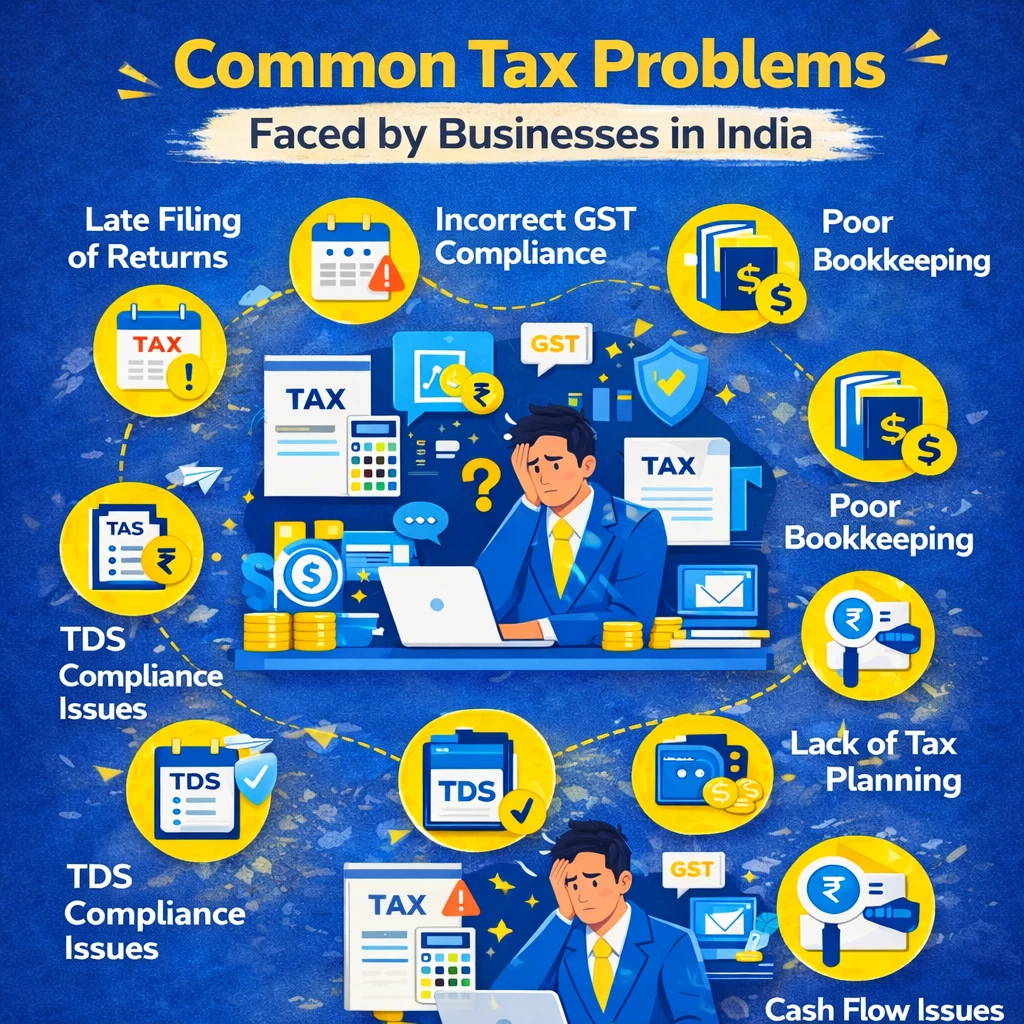

Running a business in India comes with multiple tax responsibilities. From income tax to GST and statutory compliances, even a small mistake can lead to penalties, notices, and cash flow issues. Many businesses—especially startups, SMEs, and small traders—face recurring challenges due to lack of awareness or improper compliance planning. In this blog, we discuss the Common Tax Problems Faced by Businesses in India and explain how these issues can be avoided with proper guidance, timely compliance, and professional tax support.

1. Late Filing of Tax Returns

One of the most common issues businesses face is delay in filing income tax and GST returns. Missing due dates can result in:

- Late fees and penalties

- Interest on tax payable

- Loss of input tax credit (under GST)

- Increased scrutiny from tax authorities

Solution:

Maintain a tax calendar and ensure timely filing with the help of a professional Chartered Accountant.

2. Incorrect GST Compliance

GST compliance can be complex, especially for businesses dealing with multiple invoices and vendors. Common GST-related mistakes include:

- Mismatch between GSTR-1 and GSTR-3B

- Wrong GST rate application

- Claiming ineligible input tax credit

Solution:

Regular reconciliation of returns and proper record-keeping is essential to avoid GST notices and penalties.

3. Poor Bookkeeping & Accounting Errors

Many small businesses do not maintain proper books of accounts, leading to:

- Incorrect tax calculations

- Problems during audits

- Difficulty in claiming deductions

- Cash flow mismanagement

Solution:

Maintain accurate accounting records and update them regularly using accounting software or professional services.

4. Lack of Proper Tax Planning

Businesses often pay higher taxes due to poor tax planning. Common issues include:

- Not claiming eligible deductions

- Incorrect depreciation claims

- Wrong business structure selection

Solution:

Strategic tax planning at the beginning of the financial year helps reduce tax liability legally.

5. TDS Compliance Issues

TDS (Tax Deducted at Source) is another major pain point. Common problems are:

- Non-deduction or late deduction of TDS

- Delay in TDS return filing

- Mismatch in Form 26Q / 24Q

- Penalties and interest for defaults

Solution:

Regular monitoring of TDS payments and timely return filing ensures compliance and avoids notices.

6. Responding to Income Tax Notices

Many businesses panic when they receive income tax or GST notices. Ignoring notices or replying incorrectly can worsen the situation.

Solution:

Understand the nature of the notice and respond with accurate documentation through a qualified tax professional.

7. Cash Flow Issues Due to Tax Liabilities

Unexpected tax demands or penalties can disturb business cash flow, especially for MSMEs.

Solution:

Advance tax planning and periodic tax reviews help businesses prepare in advance and manage finances smoothly.

8. Non-Compliance with Annual Filings

Businesses often miss mandatory filings such as:

- ROC filings

- Audit reports

- Annual returns

Non-compliance can result in heavy penalties and even disqualification of directors.

Solution:

Ensure annual compliance is handled systematically with professional assistance.

Why Professional Tax Support Matters

Handling taxes without expert guidance increases the risk of errors, penalties, and legal complications. A professional Chartered Accountant helps businesses:

- Stay compliant with tax laws

- Minimize tax liability legally

- Handle notices and audits confidently

- Focus on growth instead of compliance stress

Conclusion

Tax problems are common, but they are avoidable with proper planning, timely compliance, and expert guidance. Whether it’s GST, income tax, or annual filings, businesses must take tax compliance seriously to ensure smooth operations and long-term success.

If you are facing tax-related challenges or want to stay compliant without stress, consulting a professional tax advisor can make a significant difference.