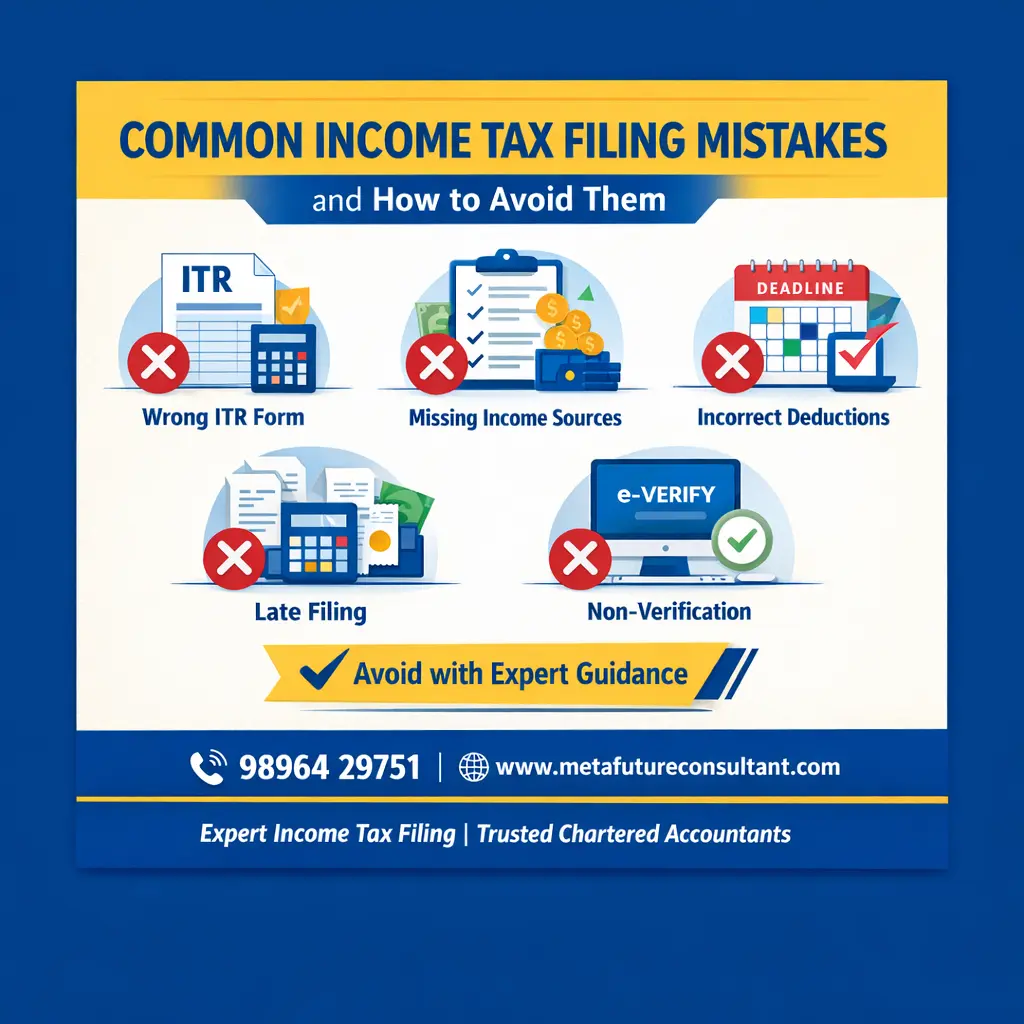

Filing an Income Tax Return (ITR) is a crucial financial responsibility for individuals, professionals, and businesses in India. However, many taxpayers make avoidable mistakes while filing their returns, which can lead to penalties, delayed refunds, scrutiny notices, or even legal consequences.

In this blog, we will discuss the most common income tax filing mistakes and explain how to avoid them, helping you stay compliant and stress-free.

1. Choosing the Wrong ITR Form

Mistake:

Many taxpayers select an incorrect ITR form due to lack of awareness. Each ITR form is designed for specific income categories.

How to Avoid:

- Salaried individuals generally use ITR-1

- Business owners and professionals should file ITR-3 or ITR-4

- NRIs usually file ITR-2 or ITR-3

Consulting a Chartered Accountant ensures the correct form is selected based on your income sources.

2. Not Reporting All Sources of Income

Mistake:

Taxpayers often forget to declare:

- Interest from savings accounts or FDs

- Rental income

- Capital gains from shares, mutual funds, or property

- Freelance or side income

How to Avoid:

- Check Form 26AS, AIS, and TIS before filing

- Declare income from all sources, even if TDS is already deducted

3. Mismatch Between ITR and Form 26AS

Mistake:

Differences between income details in your return and Form 26AS can trigger tax notices.

How to Avoid:

- Cross-verify salary, TDS, and advance tax details

- Ensure employer and bank data matches your return

4. Incorrect Claim of Deductions

Mistake:

Claiming deductions without eligibility or proper documentation under:

- Section 80C

- Section 80D

- Home loan interest

How to Avoid:

- Claim deductions only if you have valid proof

- Understand limits and conditions under each section

- Keep documents ready for future verification

5. Not Reporting Exempt Income

Mistake:

Many taxpayers believe exempt income does not need to be reported.

How to Avoid:

Even exempt income such as:

- PPF interest

- Tax-free bonds

- Dividend income

must be declared under Exempt Income in the ITR.

6. Filing After the Due Date

Mistake:

Late filing can result in:

- Late fees up to ₹5,000

- Loss of interest and deductions

- Inability to carry forward losses

How to Avoid:

- Mark due dates in advance

- File returns well before the deadline

- Seek professional assistance if documents are delayed

7. Ignoring Capital Gains Tax

Mistake:

Taxpayers often overlook capital gains from:

- Shares and mutual funds

- Sale of property

- Cryptocurrency transactions

How to Avoid:

- Calculate short-term and long-term capital gains correctly

- Apply correct tax rates and exemptions

- Maintain transaction records

8. Incorrect Bank Account Details

Mistake:

Wrong bank details can delay or block income tax refunds.

How to Avoid:

- Enter correct account number and IFSC code

- Pre-validate bank account on the income tax portal

9. Not Verifying the ITR

Mistake:

Filing the return but not verifying it within 30 days makes the return invalid.

How to Avoid:

- Verify ITR using Aadhaar OTP, net banking, or EVC

- Complete verification immediately after filing

10. Handling Income Tax Notices Without Expert Help

Mistake:

Ignoring notices or replying incorrectly can worsen the situation.

How to Avoid:

- Never ignore income tax notices

- Seek help from a Chartered Accountant for accurate and timely responses

Why You Should Consult a Chartered Accountant

A professional CA helps you:

- Avoid costly tax filing mistakes

- Optimize tax savings legally

- Ensure full compliance with income tax laws

- Handle scrutiny, notices, and assessments confidently

Conclusion

Income tax filing may seem simple, but even small errors can lead to serious consequences. By understanding these common income tax filing mistakes and how to avoid them, you can ensure accurate filing and peace of mind.

For hassle-free income tax filing and expert guidance, consulting a qualified Chartered Accountant is always a smart decision.